IRC Section 409A Valuation

Anchor Business Valuation, LLC has over a decade of the required experience and expertise to help you with a smooth processing of your 409A valuation. Our team members have performed hundreds of 409A valuations across diverse sectors, right from pre-revenue staged Companies to the pre-IPO. Anchor’s entire execution process is subjected to rigorous, multi-time quality checks to ensure the maintenance of the highest quality standards. Emphasis on methodology documents and auditability ensures that the projects delivered are highly consistent and within a defined time frame.

409A Valuation

Brief Background

Section 409A was introduced as Internal Revenue Code (“IRC”) by the Internal Revenue Service (“IRS”) through Section 885 of the American Jobs Creation Act of 2004 in October 2004 and took effect on December 31, 2004.

IRC Section 409A was enforced by the IRS in response to the 2001 scandal by the Enron Corporation that involved several compensation related accounting frauds. Amongst Enron’s fraudulent activity, was the grant of large stock options awards deferred compensation to Enron’s key executives. Prior to Enron’s bankruptcy in 2001, certain key executives accelerated the vesting of, and exercised, their stock options and sold the underlying stock when Enron’s shares were trading at all-time highs. These actions protected select individual interests while the remaining Enron employees lost a significant portion of their retirement savings. As a result of Enron’s nefarious actions, the IRS on January 1, 2005, added Section 409A to the IRC and changed a number of rules governing deferred compensation plans, including the regulations related to a company’s executives’ ability to choose when to receive such deferred compensation.

Deferred Compensation Plans

Before understanding the applicability of IRC Section 409A on businesses, it is necessary to understand Deferred Compensation Plans.

Companies that are experiencing growth in their operations want to attract and retain key talent to continue growing. Start-up companies often have limited cash flow to grow the business, and thus, look to non-cash compensation alternatives for key employees. As a result, these businesses offer future incentive employee benefits in the form of Deferred Compensation Plans. There are two categories of Deferred Compensation Plans which are detailed below:

- Qualified Deferred Compensation Plans(“QDC”) such as 401(K), 457 or 403(b) plans, offer tax advantages to employees by deferring a percentage of their compensation for future savings post retirement, disability, death events, and benefits on current income taxes. These plans are strictly governed and have contribution limits, meaning an employee cannot contribute more than a certain amount each year into the plan.

- Nonqualified Deferred Compensation Plans (“NQDC”) carry additional benefits above that of Qualified Deferred Compensation Plans, including non-IRS-defined compensation deferral limits, which means that there is no limit to how much an employee can contribute with an NQDC plan. Additional benefits of NQDC’s, as compared to QDC’s, include less taxable income for employees when they make a deferral election and no mandatory IRS required minimum distributions (allowing the deferred compensation to continue to grow).

Compliance Scope and Penalties

As noted above, IRC Section 409A applies to compensation deferred under a “Nonqualified Deferred Compensation Plan”. The IRS regulates the treatment of NQDS plans for federal income tax purposes. All companies that enter a NQDC arrangement with their employees must follow specific rules outlined under IRC Section 409A.1

Failure to comply with these rules carries heavy penalties for the employee in the risk of losing the tax-deferred plan status, and subjecting participants to their plan compensation deferrals declared immediately taxable at a participant’s regular tax rate, a 20% additional federal income tax penalty, subject state tax penalties, plus an additional underpayment penalty of 1% above the IRS’s general underpayment penalty (in case the employee fails to pay the tax in a timely manner)2. For the companies that fail to abide by the Section 409A rules, additional penalties come in the form of payroll taxes on the plans offered, and a decreased value when/if the company decides to file an initial public offering (“IPO”).

As an aside, Section 409A has no effect on the Federal Insurance Contributions Act (“FICA”) (aka Social Security and Medicare) tax3.

Section 409A – Valuation

Introduction

As per IRC Section 409A rules, any private company that grants to its employees, “equity-based compensation” in the form of stock options, stock appreciation rights, warrants, restricted stocks, restricted stock units, performance stock units, and other, must first determine the Fair Market Value (“FMV”) of its stock4. The date of valuation should be as close to the grant date5 of the equity-based compensation award as possible. Additionally, the valuation must be updated, at a minimum, on an annual basis, or in case of any material event triggered (whichever is earlier). “Material events”6 can include new equity financings; an acquisition offer by another company; certain instances of secondary sales of common stock; and significant changes (good or bad) to a company’s financial outlook. A company credibly approaching IPO will also conduct 409A valuations more frequently (e.g., quarterly or even monthly).7

General Guidelines

Private companies that get an independent valuation done for their stock within 12 months of the date of granting equity-based awards, such as stock options to their employees, are deemed to follow a “Safe Harbor” valuation approach compliant with IRC Section 409A. A “Safe Harbor” approach is beneficial for the company as the reasonableness of the fair market value proof of burden is then on the IRS versus the subject company (i.e., if the IRS challenges the valuation of the stock price of the subject company).

The end goal of a 409A valuation is to determine the FMV of a company’s stock as of the date of grant of the equity-based compensation award. The determined FMV of the stock serves as the predetermined Strike8 Price of the option which the employee exercises at a future date to purchase the company’s shares. The employee will realize gain of the exercised option if it is “in-the-money”, i.e. the Strike Price is less than the current FMV of the privately held company’s stock. If the option is “out of the money”, meaning the Strike Price is above that of the underlying stock, then the employee loses the cost of the option and does not exercise the security. It is therefore very important that the FMV of the subject company’s stock be valued correctly to maximize gain for its employees and shareholders.

Valuation Steps

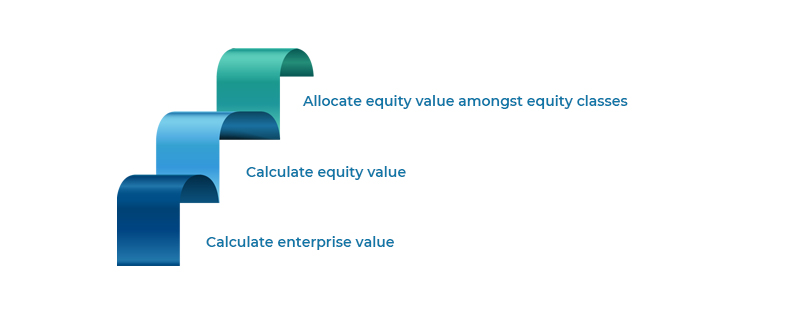

Most often a private company has a complex capital structure comprised of multiple classes of securities including common stock, preferred stock, options, and warrants. The valuation process for determining the FMV of the subject company’s common stock is presented in a simplified manner below:

STEP 1 –Calculate Enterprise Value of the Subject Company

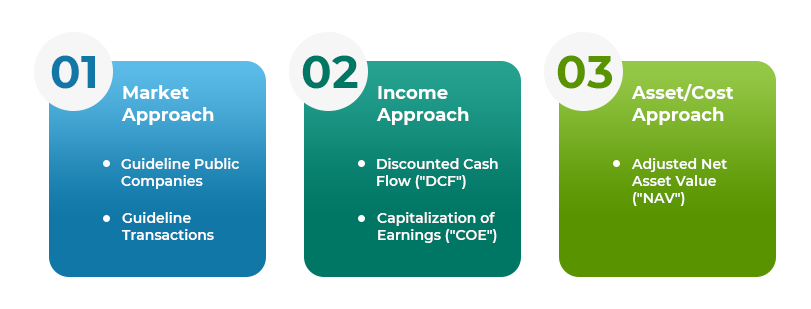

There are three commonly used approaches to determine the Enterprise Value of the company (detailed below together with methodological examples, not an exhaustive list, of each approach).

1. Market Approach:

- Guideline Public Companies Method value is derived using several publicly traded companies that are similar in size, and industry – Comparable Set. The selected multiple, such as, EBITDA, Revenue, Net Income, etc., of this Comparable Set is then used to determine and calculate the Enterprise Value of the subject company.

- Guideline Transactions Method the Guideline M&A Transaction Methodology within the Market Approach uses actual prices paid in merger and acquisition transactions for companies similar to the Company. Exit multiples of total purchase price paid to revenues, EBIT, EBITDA, net income and/or book value may be developed for each comparable transaction, if the data is available. These multiples are then applied to the Company’s corresponding latest 12-month and projected financial metrics

2. Income Approach:

3. Asset/Cost Approach:

- This is a less commonly used valuation approach in which the value is determined based on a difference between the FMV of balance sheet assets and liabilities (often including non-balance sheet items in the value determination). The principal method used in the asset approach is the Adjusted Net Asset Value (“NAV”) method. This method is often costly as it necessitates valuations of the individual balance sheet items and, for a going concern business, frequently results in the lowest value determined (over that of the income and market approaches).

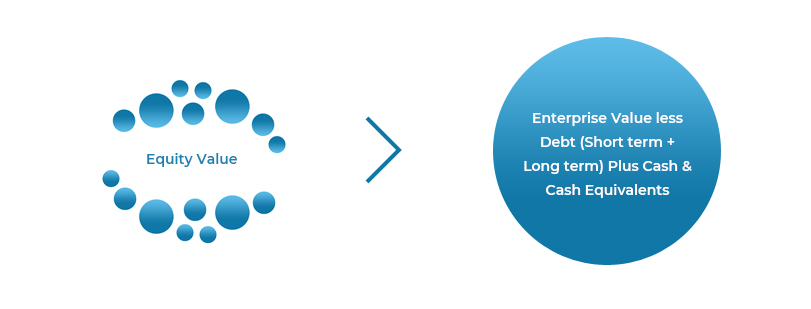

STEP 2 – Calculate Equity Value of the Subject Company

After determining the Enterprise Value, the next step is to arrive at the Equity Value of the subject company.

STEP 3 – Allocate Equity Value to each class of subject company’s capital structure – Equity Allocation

Often the capital structure of a privately held company is comprised of more than one class of securities, such as, common stock, preferred stock, options, or warrants. This multi-class equity composition makes up what is called a “Complex Capital Structure”. Such complex capital structures require an allocation of equity value to each class within the company’s capital structure.

Commonly used methods for Equity Allocation include:

1. The Option Pricing Method (OPM):

- This method considers common stock and preferred stock as call options (to purchase at a certain price) on the equity value, and base exercise prices on the liquidation preferences10 of the preferred stock. The base price is needed to construct the incremental value in the breakpoints. Appraisers widely use this method in situations in which future liquidity events are difficult to forecast (such events can be in the form of an IPO, merger and/or acquisition transaction, and entity dissolution). The most used OPM is the Black-Scholes Option Pricing Model.

2. Probability Weighted Expected Returns Method (PWERM):

- This method of allocation bases share value upon the probability-weighted present value of expected future investment returns, with consideration for each of the probable future outcomes available to the enterprise, as well as the rights of each share class. Commonly applied “future outcomes” include an IPO, a merger and/or acquisition, divestiture, or continuance as a private company. PWERM estimates the range of the future and present value under each future outcome and applies a probability factor11 to each outcome as of the valuation date.

3. Current Value Method (CVM):

- The CVM method of allocation bases equity value estimates on a controlling basis assuming an immediate sale or liquidation of the enterprise. Allocation is then made on the basis of based on the series’ liquidation preferences or conversion values, whichever is greater.

Reach out to us today for a free consultation at info@anchorbvfs.com or (239) 919-3092

1Final IRS Section 409A regulations dated April 17, 2007 https://www.irs.gov/irb/2007-19_IRB#TD-9321

2Section 409A frequently asked questions

https://www.irs.gov/newsroom/frequently-asked-questions-sec-409a-and-deferred-compensation

3Source: FICA taxes are taken out prior to the compensation deferral

https://www.irs.gov/irb/2007-19_IRB#TD-9321

4The IRS notes that, as needed, appraisals must be performed by a qualified appraiser https://www.law.cornell.edu/cfr/text/26/1.170A-17.

5Grant date is the date on which a stock option or other equity-based award is granted to the recipient. The grant date is considered to be that date on which an employer and an employee agree upon the most essential terms and conditions associated with the award.

6A “material event” is an event that can affect a company’s stock price.

7Source: https://www.irs.gov/irb/2007-19_IRB#TD-9321

8Source: https://www.investopedia.com/terms/s/strikeprice.asp

9Refer to International Glossary of Business Valuation Terms, June 2001, for further detail on various valuation “terms of art”. https://www.nacva.com/glossary

10i.e., order of preference during break point construction.

11Discussions with company management are imperative.

- IRC Section 409A Valuation

- This approach involves valuing the subject company based on specific benefit streams – Earnings or Cashflows. Commonly used income approach methods in 409A valuations are the Discounted Cash Flow (“DCF”), and the Capitalization of Earnings (“COE”) methods.